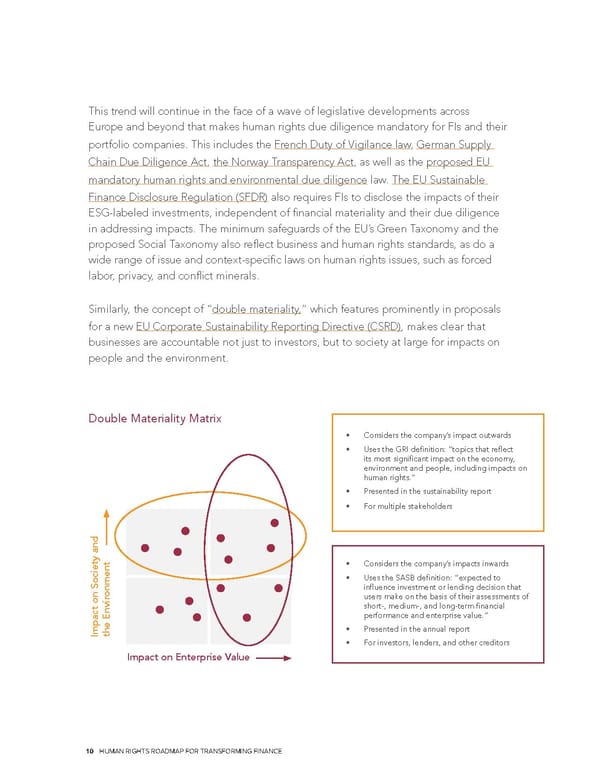

This trend will continue in the face of a wave of legislative developments across Europe and beyond that makes human rights due diligence mandatory for FIs and their portfolio companies. This includes the French Duty of Vigilance law, German Supply Chain Due Diligence Act, the Norway Transparency Act, as well as the proposed EU mandatory human rights and environmental due diligence law. The EU Sustainable Finance Disclosure Regulation (SFDR) also requires FIs to disclose the impacts of their ESG-labeled investments, independent of financial materiality and their due diligence in addressing impacts. The minimum safeguards of the EU’s Green Taxonomy and the proposed Social Taxonomy also reflect business and human rights standards, as do a wide range of issue and context-specific laws on human rights issues, such as forced labor, privacy, and conflict minerals. Similarly, the concept of “double materiality,” which features prominently in proposals for a new EU Corporate Sustainability Reporting Directive (CSRD), makes clear that businesses are accountable not just to investors, but to society at large for impacts on people and the environment. Double Materiality Matrix • Considers the company’s impact outwards • Uses the GRI definition: “topics that reflect its most significant impact on the economy, environment and people, including impacts on human rights.” • Presented in the sustainability report • For multiple stakeholders • Considers the company’s impacts inwards • Uses the SASB definition: “expected to onment influence investment or lending decision that users make on the basis of their assessments of short-, medium-, and long-term financial performance and enterprise value.” he Envir • Presented in the annual report Impact on Society and t • For investors, lenders, and other creditors Impact on Enterprise Value 10 HUMAN RIGHTS ROADMAP FOR TRANSFORMING FINANCE

Human Rights Roadmap for Transforming Finance Page 9 Page 11

Human Rights Roadmap for Transforming Finance Page 9 Page 11