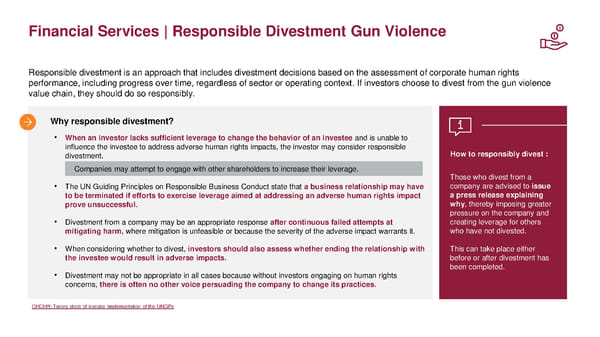

Financial Services | Responsible Divestment Gun Violence Responsible divestment is an approach that includes divestment decisions based on the assessment of corporate human rights performance, including progress over time, regardless of sector or operating context. If investors choose to divest from the gun violence value chain, they should do so responsibly. Why responsible divestment? • When an investor lacks sufficient leverage to change the behavior of an investee and is unable to influence the investee to address adverse human rights impacts, the investor may consider responsible How to responsibly divest : divestment. Companies may attempt to engage with other shareholders to increase their leverage. Those who divest from a • The UN Guiding Principles on Responsible Business Conduct state that a business relationship may have company are advised to issue to be terminated if efforts to exercise leverage aimed at addressing an adverse human rights impact a press release explaining prove unsuccessful. why, thereby imposing greater pressure on the company and • Divestment from a company may be an appropriate response after continuous failed attempts at creating leverage for others mitigating harm, where mitigation is unfeasible or because the severity of the adverse impact warrants it. who have not divested. • When considering whether to divest, investors should also assess whether ending the relationship with This can take place either the investee would result in adverse impacts. before or after divestment has been completed. • Divestment may not be appropriate in all cases because without investors engaging on human rights concerns, there is often no other voice persuading the company to change its practices. OHCHR: Taking stock of investor implementation of the UNGPs

Toolkit for Corporate Action to End Gun Violence Page 53 Page 55

Toolkit for Corporate Action to End Gun Violence Page 53 Page 55